TAXATION

SYSTEMATIC STUDY :

1. INCOME TAX LAW : An understand of the income-tax law requires a study of the following:

(A) The income-tax Act,1961 (amended up-to-date )

(B) The income-tax Rules,1962 (amended up-to-date)

(C) Circulars,clarifications issued from time to time by the CBDT

(D) Judicial decisions

(A) The Income-tax Act,1961(Amended upto date):The provisions of income-tax are contained in the income-tax Act,1961 which extends to the whole of India and became effective from 1.4.1962(section 1)

Scope of income-tax Act :The income-tax Act contains provisions for determination of taxable income,determination of tax liability,procedure for assessment,appeals,penalties and prosecution.It also lays down the powers and duties of various Income-tax authorities.

Since the Income-tax Act,1961 is a revenue law,there are bound to be amendments from time to time in this law.Therefor,the Income-tax Act has undergone innumerable changes from the time it was originally enacted.These amendments are generally brought in annually alongwith the Union Budget.Besides these amendments,whenever it is found necessary,the Government introduces amendments in the form of various Amendment Acts and Ordinances.

Annual amendments :Every year a budget is presented before the parliament by the Finance Minister.One of the most important components of the Budget is the Finance Bill,which declares the financial proposals of the Central Government for the next financial year.The Bill contains various amendments which are sought to be made in the areas of direct and indirect taxes levied by the Central Government.

(B) Income-tax Rules,1962(amended upto date) :Every Act normally gives power to an authority,responsible for implementation of the Act,to make rules for carrying out purposes of the Act.Section 295 of the income-tax Act has given power to the Central Board of Direct Taxes(CBDT)to make such rules,subject to the control of Central Government.These rules are made applicable by notification in the Gazette of India.

(C) Circulars and Clarifications by CBDT :The CBDT has been issuing certain circulars and clarifications from time to time,which have to be followed and applied by the Income-tax Authorities.A circular or clarification is a communication issued by the CBDT which is primarily meant to serves as guidelines to implement the provisions of law.Such circulars or clarifications are binding upon the Income-tax Authorities,but the same are not binding on the assessee.However,although the assessee can claim benefit under such circulars.

(D) Judicial decisions :Decision given by judicial authorities on an appeal filed before them is known as judicial decision.Any decision given by the Supreme Court becomes a law which will be binding on all the courts.Appellate Tribunals,the Income-tax Authorities as well as on all the assesses.

SCHEME OF TAXATION : Income-tax is levied in India in the following manner :

1. Income earned by every person is chargeable to income-tax provided it exceeds the maximum amount which is not chargeable to tax i.e,it exceeds the maximum exemption limit.

2. It is charged on the total income of the previous year but is taxable in the next following assessment year at the rates applicable to such assessment year.However,there are certain exceptions to this rule.

3. Income-tax is charged at two rates,viz, normal rates and special rates.

Normal tax rates which can be in the form of slab rate or flat rate are fixed by the annual Finance Act but special rates are given in the Income-tax Act.

4. Tax is charged on the total income computed in accordance with the provisions the Act.

5. Total income of a person is determined on the basis of his residential status in India.

6. Although the Income of the previous year is chargeable to tax in the assessment year,but the assessee has to pay income-tax in the same previous year in which income is earned.It is paid in the form of advance tax and deduction of tax at source(TDS).Such tax paid in the previous year(also known as prepaid taxes)shall be deducted from the income tax due on total income in the assessment year.

Further,an analysis of the above statement would reveal the following important concepts,which are necessary for understanding the frame work of the Income-tax Act.

1. Person; 2.Assessee; 3.Assessment year; 4.Previous year; 5.Rate or rates of tax; 6.Charge of income-tax; 7.Maximum amount which is not chargeable to income-tax; 8.Total income; 9.Residential status.

MEANING OF SALARY :

Section 17(1) gives an inclusive definition of ‘salary’

Salary includes :

(1) Wages;

(ii) any annuity or pension;

(iii) any gratuity;

(iv) any fees,commissions,perquisites or profits in lieu of or in addition to any salary or wages;

(v) any advance of salary;

(vi) any payment received by an employee in respect of any period of leave not availed by him;

(vii) Employer’s contribution to recognized provident Fund(RPF)in excess of 12% of employee’s salary and interest credited to recognized provident fund in excess of 9.5%p.a.);

(viii) the aggregate of all sums that are comprised in the transferred balance of an employee participating in a recognised provident fund to the extent to which it is chargeable to tax;

(ix) the contribution made by the central government or any other employer in the previous year,to the account of an employee under a notified pension scheme preferred to in section 80CCD.

Although the above incomes are included in salary,but there are certain incomes,mentioned above,which are either tax free or fully exempt,upto a certain limit.The aggregate of above incomes,after the exemption(s)available,if any,is known as’Gross salary’.From the gross salary,the

following two deductions,are allowed under section 16 :

(i) Deduction for entertainment allowance [Section 16(ii)];and

(ii) Deduction on account of any sum paid to wards tax on employment[Section 16(ii)].

The amount arrived at,after allowing the above deductions,is the income under the head ‘salaries’.

TREATMENT OF VARIOUS INCOMES TO BE INCLUDED IN GROSS SALARY :

WAGES : Conceptually there is no defference between salary and wages.Therefore,wages are treated just like salary and are taxable on the same basis as salary.

ANNUITY : Annuity is an annual grant and when made by an employer falls under the head Salaries.It may be paid by the employer voluntarily or on account of a contractual agreement.When annuity is payable by a present employer,it is taxable as salary.If it is received from a former employer then it is taxed as profits in lieu of salary.A deffered annuity will not be taxable until the right to receive the same arises.Other forms of annuities,for example,those made under a will by settler or granted by a life assurance company,or accruing under a contract,come under the head “Income from other Sources “ and they shall have to be assessed under section 56.

RETIREMENT BENEFITS : The following retirement benefits have been discussed later in this Chapter :

(A) Pension (see para 4.37 )

(B) Gratuity (see para 4.36)

(C) Leave encashment (see para 4.38)

(D) Retirement compensation (see para 4.39)

(E) Compensation received on voluntary retirement (see para 4,40)

TREATMENT OF BONUS : Bonus is taxable on receipt basis.Therefore,it will be included in the gross salary only in the year in which the bonus is received.If bonus is received in arrears,the assessee can claim relief under section 89.

SALARY IN LIEU OF NOTICE PERIOD : This is taxable in the previous year in which it is received.

Meaning of notice period :Normally,if any employer wants to terminate the services of an employee,he gives notice of his intention to do so.e,g.as per the contract of service,he may have to give three months notice in advance to the employee.This is known as notice period.Sometime employer instead of giving him a notice gives him salary for the notice period and terminates him immediately.This amount paid by the employer is known as salary in lieu of notice period and is fully taxable in the hands of the employee.

FEE AND COMMISSION : Any fee or commission paid/payable by the employer to the employee shall be fully taxable and thus would be included in gross salary.Commission may be afixed amount or a fixed percentage of turnover or net profit etc.But it will be taxable under the head ‘salaries’only when it is paid/payable by employer to employee.

OVERTIME PAYMENTS : Any payment made by the employer to the employees for working beyond the office hours or for any extra work done by the employees is taxable and therefore,included in Gross Salary.

ALLOWANCES

Meaning and type of allowances : Allowance is a fixed monetary amount paid by the employer to the employee for meeting some particular expenses,whether personal or for the performance of his duties.These allowances are generally taxable and are to be included in the gross salary unless a specific exemption has been provided in respect of any such allowance.Specific exemption in respect of allowances are provided under the following sections :

(i) House Rent allowance-Section 10(13 A)

(ii) Prescribed special allowances – Section 10(14)

The above allowances shall be exempt either in full or upto a certain limit and the balance,if any,shall be taxable and thus included in gross salary.

Entertainment allowance,however,does not fall under section 10 and therefor it is not subject to any exemption.The entire entertainment allowance received by an employee is first included in gross salary and thereafter a deduction under section 16(ii) is allowed only to a government employee from gross salary on account of such entertainment allowance already included.The same is discussed later.

The treatment of some of the allowances is as under :

House Rent Allowance [section 10(13 A)and Rule 2 A] :House rent allowances is given by the employer to the employee to meet the expenses in connection with rent of the accommodation which the employee might have to take.HRA is taxable under the head ‘salaries’to the extent it is not exempt under section 10(13A).HRA is exempt under section 10(13A) to the extent of the minimum of the following three amounts :

(a) Actual House Rent Allowance received by the employee in respect of the relevant period.

(b) Excess of rent paid for the commodation occupied by him over 10% of the salary for the ‘relevent period’.

(c) 50% of the salary where the residential house is situated at Mumbai,Kolkata,Delhi or Chennai and 40% of the salary where the house is situated at any other place,for the relevant period.

‘Relevent period’means the period during which the said accommodation was occupied by the assessee during the previous year.

The minimum of the above three amounts shall be exempt from tax and the balance shall be taxable and thus included in gross salary of the employee.

NOTE :

1. Salary for this purpose includes dearness allowance if the term of employment so provide but exclude all other allowances and perquisites.Thus dearness allowance will be include to the extent it is part of salary as per term of employment.All other allowances and perquisites will not be include.However,as per the supreme court decision,commission,if received as a fixed percentage of turnover achieved by employee,would form part of the salary [Gestetner duplicators Pvt.Ltd v CIT (1979)117 ITR 1(SC)].

2. Salary is to be taken on ‘due’ basis in respect of the period during which the rented accom-modation is occupied by the employee in the previous year.The salary of any other period is not to be included even though it may be received and taxed during the previous year.

3. Where the employee has not actually incurred expenditure on payment of rent or stays in his own accommodation,no exemption of H.R.A. is available.

Prescribed allowances which are exempt to acertain extent[section 10 (14)] : Prescribed allowances which are exempt under section 10(14) are of the following two types :

(i) Special allowances for performance of official duties : These allowances are not in the nature of a perquisite within the meaning of section 17(2) and are specifically granted to meet expenses wholly,necessarily and exclusively incurred in the performance of duties of an office or employment of profit.These allowances will be exempt the extent such expenses are actually incurred for that purpose.[section 10 (14)(i)].

(ii) Allowances to meet personal expenses : These allowances are granted to the employee to meet his personal expenses either at the place where the duties of his office or employment of profit are ordinarily performed by him or at the place where he ordinarily resides.These allowances are exempt to the extent prescribed.[section 10 (14)(ii)].

Special allowances which are exempt to the extent of actual amount received or the amount spent for the performance of the duties of an office or employment of profit,whichever is less:These allowance are :

(a) Travelling allowance :Any allowance granted to meet the cost of travel on tour or on transfer of duty. “Allowance granted to meet the cost of travel on transfer” includes any sum paid in connection with transfer,packing and transportation of personal effects on such transfer.

(b) Dailly Allowance :Any allowance,whether granted on tour or for the period of journey in connection with transfer,to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

(c)Conveyance allowance :Any allowance granted to meet the expenditure incurred on conveyance in performance of duties of an office or employment of profit,provided that free conveyance is not provided by the employer.Expenditure incurred on journey from residence to office and back to residence shall not be treated as expenditure incurred on conveyance in performance of official duties;

(d)Helper allowance :Any allowance,by whatever name called,granted to meet the expenditure incurred on a helper where such helper is engaged for the performance of the duties of an office or employment of profit;

(e)Academic allowance :Any allowance,by whatever name called,granted for encouraging academic research and training pursuits in educational and research institutions;

(f)Uniform allowance :Any allowance,by whatever name called,granted to meet the expenditure incurred on the purchase or maintenance of uniform for wear during the performance of the duties of an office or employment of profit.

The above allowances shall be exempt to the extent of minimum of the following :

(1) Actual allowance received.

(2) Actual amount spent for the purposes of duties of office or employment.

Allowances to Meet Personal Expenses : These allowances can be of the following two types :

(1) Allowances which are exempt to the extent of amount received or the limit specified,whichever is less

(2) Allowance which is exempt to the extent of certain percentage of amount received.

Allowance Which are Exempt to The Extent of Amount received or the limit specified,whichever is less :

(a) Children education allowance :Exempt upto actual amount received per child or Rs100 p.m. per child upto a maximum of 2 children,whichever is less.

(b) Hostel expenditure allowance : Exempt upto actual amount received per child or Rs300 p.m. per child upto a maximum of two children,whichever is less.

(c) Tribal area,scheduled Area/Agency area allowance : Exempt upto actual amount received or Rs200 per month, whichever is less.

(d)Special compensatory hilly area allowance or high altitude allowance etc,:Exemption varies from Rs300 –Rs7,000 per month.

(e) Border area,remote area allowance,disturbed area allowance, etc, (as per given later):Exemption varies from Rs200 p.m. to Rs 1,300 p.m.

(f) Compensatory field area allowance :Exempt to the extent of Rs 2,600 p.m.

(g) Compensatory,modified field area allowance :Exempt to the extent of Rs 1,000 p.m.

(h) Counter insurgency allowance granted to members of armed forces :Exempt to the extent of Rs3,900p.m.

(i) Transport allowance : Any transport allowance granted to an employee to meet his expenditure for the purpose of commuting between the place of his residence and the place of his duty,to the extent of Rs800 per month.

However,such transport allowance granted to an employee,who is blind or orthopaedically handicapped with disability of lower extremities,is exempt to the extent of Rs1,600 p.m. instead of Rs800.

(j) Underground allowance : Any underground allowance granted to an employee who is working in uncongenial,unnatural climate in underground mines shall be exempt to the extent of Rs800 p.m.

(k) High altitude(uncongenial climate)allowance :Given to the member of the armed forces for altitude of 9000 ft to 15000 ft Rs1,060 p.m. and for altitude above 15000 ft Rs 1,600 p.m.

(l) Special compensatory highly active field area allowance granted to members of armed forces :Exempt to the extent of Rs4,200 p.m.

(m)Island (duty)allowance :Given to the member of the armed forces in the Andaman & Nicobar and Lakshadweep group of Islands exempt to the extent of Rs3,250 p.m.

Allowance which is exempt to the extent of certain percentage of amount received :

Allowance allowed to transport employees working in any transport system : If any fixed allowance is given by the employer to the employee who is working in any transport system,to meet his personal expenditure during his duty performed in the course of running of such transport from one place to another,the amount of exemption shall be 70% of such allowance or Rs10,000 p.m. whichever is less.

TREATMENT OF ENTERTAINMENT ALLOWANCE : This deduction is allowed only to a government employee.Non-government employees shall not be aligible for any deduction on account of any entertainment allowance received by them.

In case of entertainment allowance,the assessee is not entitled to any exemption but he is entitled to a deduction under section 16(ii) from gross salary.Therefore,the entire entertainment allowance received by any employee is added in computation of the gross salary.The government employee is,then,entitled to deduction from gross salary under section 16(ii) on account of such entertainment allowance to the extent of minimum of the following 3 limits.

(i) Actual entertainment allowance received during the previous year.

(ii) 20% of his salary exclusive of any allowance,benefit or other perquisite.

(iii) Rs 5,000.

NOTE :

1. For purpose of education in respect of entertainment allowance,the actual amount spent towards entertainment expenses is irrelevant.Even if the government employee spends the entire amount of entertainment allowance or even an amount greater than the entertainment allowance received is spent on entertainment for official purposes,the deduction shall be minimum of the above 3 limits.

2. Amount actually spent out of entertainment allowance is irrelevant for claiming deduction.

3. Sumptuary allowance has to be treated as an entertainment allowance.

ALLOWANCES WHICH ARE FULLY TAXABLE : All other allowances excepting those discussed in preceding paras,are fully taxable.Some of such allowances are enumerated as under :

(1) Dearness Allowance (DA)

(2) City Compensatory Allowance (CCA)

(3) Medical Allowance:Fully taxable,irrespective of whether any amount has been spent on medical treatment or not.

(4) Lunch Allowance/tiffin allowance

(5) Overtime Allowance

(6) Servant Allowance

(7) Warden Allowance

(8) Non-practising Allowance

(9) Family Allowance.

PERQUISITES :

What Are Perquisites ?

= A perquisite is defined in the Oxford English Dictionary as any casual emolument,fee,or profit,attached to an office or position in addition to the salary or wages.Perquisite has a known normal meaning,namely,personal advantage.In simple words,perquisites are the benefits in addition to normal salary to which the employee has a right by virtue of his employment.

Thus,’perquisites’ are the benefits or amenities in cash or in kind,or in money or moneys worth and also amenities which are not convertible into money,provided by the employer to the employee whether free of cost or at a concessional rate.Their value,to the extent these go to reduce the expenditure that the employee normally would have otherwise incurred in obtaining these benefits and amenities,is regarded as part of the taxable salary.

The essential feature of a perquisite is that an employee should have a right to the same and that it should not be a mere voluntary or contingent payment.

Definition Of ‘Perquisite’as Per Section 17(2) : Section 17(2)of the Income-tax Act,1961 gives an inclusive definition of ‘perquisite’.As per this section ‘perquisite’ includes :

(i) The value of rent-free accommodation provided to the assessee by his employer

(ii) The value of any concession in the matter of rent respecting any accommodation provided to the assessee by his employer

(iii) The value of any benefit or amenity granted or provided free of cost or at concessional rate in any of the following cases :

(a) by a company to an employee,who is a director thereof;

(b) by a company to an employee being a person who has a substantial interest in the company;

(c) by any employer(including a company)to an employee to whom the provisions of clause(a)and(b) do not apply and whose income under the head Salaries(whether due from,or paid or allowance by,one or more employers),exclusive of the value of all benefits or amenities not provided for by way of monetary payment,exceeds Rs 50,000.

These employer also known as “specified employees”

(iv) any sum paid by the employer in respect of any obligation which,but for such payment,would have been payable by the assessee.

(v) any sum payable by the employer whether directly or through a fund,other than a recognised provident fund or an approved superannuation fund or deposit-linked insurance fund,to effect an assurance on the life of the assessee or to effect a contract for an annuity.

(vi) the value of any specified security or sweat equity shares allowed or transferred directly or indirectly by the employer or former employer free of cost or at concessional rate to the assessee

(vii) The amount of any contribution to an approved supperanuation fund by the employer in respect of the assessee to the extent it exceeds Rs1,00,000;and

(viii) The value of any other fringe benefit or amenity as may be prescribed.

TAXABILITY OF PERQUISITES : For income-tax purposes,perquisites may be divided into five categories :

(a) Perquisites which are taxable in the hands of all categories of employees.

(b) Perquisites which are taxable only when the employee belongs to specified group i.e,he is a specified employee.

(c) Specified security or sweat equity shares allotted or transferred by the employer to the assessee.

(d) Contribution by the employer to the approved superannuation fund in respect of assessee to the extent it exceeds Rs1,00,000.

(e) Tax-free perquisites.

PERQUISITES WHICH ARE TAXABLE ONLY IN THE CASE OF SPECIFIED EMPLOYEES :

Any benefit/amenity in the form of a facility(other than rent free accommodation,concession in the matter of rent or fringe benefits or amenities as may be prescribed) provided by the employer,which is not tax-free,shall be taxable only in the hands of specified employees.Some of these are :

(i) Services of a sweeper,gardener,watchman or personal attendant

(ii) free or concessional use of gas,electric energy and water for household consumption,

(iii) free or concessional educational facilities,

(iv) use of motor car,

(v) personal or private journey provided free of cost or at concessional rate to an employee or member of his household,

(vi) the value of any other benefit or amenity,service,right or privilege provided by the employer.

WHO IS SPECIFIED EMPLOYEE [SECTION 17(2)(III)] : An employee shall be a specified employee,if he falls under any of the following three categories :

(i) He is a Director of a company;or

(ii) He i.e,the employee,has a substantial interest in the company.As per section 2(32),person who has a substantial interest in the company,in relation to a company means a person who is the beneficial owner of shares,not being shares entitled to a fixed rate of dividend whether with or without a right to participate in profits,carrying not less than 20% of the voting power;Here the word beneficial owner is significant.It means that even if a person is not a registered holder of shares in a company but has beneficial interest in such shares,he shall be covered by this definition and conversely,even if a person is a registered holders of shares but has no beneficial interest in such shares,he shall not be covered by this definition.Thus,the beneficial ownership is the criterion under this definition.

(iii) his income under the head ‘salaries’(whether due from,or paid or allowed by, one or more employers),exclusive of the value of all benefits or amenities not provided for by way of monetary payment,exceeds Rs50,000.Income for this purpose,shall include all taxable monetary payments like

basic salary,dearness allowance,bonus,commission,taxable allowances/perquisites but shall not include the value of any non-monetary benefits/perquisites.The following are to be deducted from salary for this purpose :

(a) Entertainment allowance (to the extent deductible under section 16(ii);

(b) Tax on employment [section 16 (iii)].

VALUATION OF PERQUISITES

Rent free accommodation Provided at Concessional Rate :

Accommodation provided to the employee may be :

(i) Unfurnished

(ii) Furnished

Further,such accommodation may be provided:

(a) Rent free;or

(b) at concessional rate

As per amended rule 3(1),the valuation of accommodation should be done as under :

(A) Accommodation Provided By The Government to Its Employees : Where the accommodation is provided by Central or State Government to their employees either holding office or post in connection with the affairs of Union or such State,the value shall be determined as under :

(i) Where the accommodation is unfurnished :

(a) If the accommodation is provided rent free:The value shall be the license fee determined by Union or State Government in respect of accommodation in accordance with the rules framed by that government for allotment of houses to its officers.

(b) Where the accommodation is provided at concessional rate :We shall first assume as if it is provided rent free and the valuation shall be the license fee.For valuation of concession,such license fee shall be reduced by the rent actually by the employee.

(ii) Where the accommodation is furnished : The value of perquisite shall be determined as if it is an unfurnished accommodation which may be provided rent fee or at concessional rate (i.e,value determined as per clause (i) above ).Such value shall be increased by 10%p.a. of the cost of furniture (including television sets,radio sets,refrigerator,other household appliances,air conditioning plant or equipment )or if such furniture is hired from a third party,the actual hire charges paid or payable for the same.The valuation of furniture shall be reduced by any charges paid or payable for such furniture by the employee during the previous year.

Where the accommodation is provided by other employer : Accommodation provided as rent free or at concessional rate may be owned by the employer or taken on lease or rent by the employer.

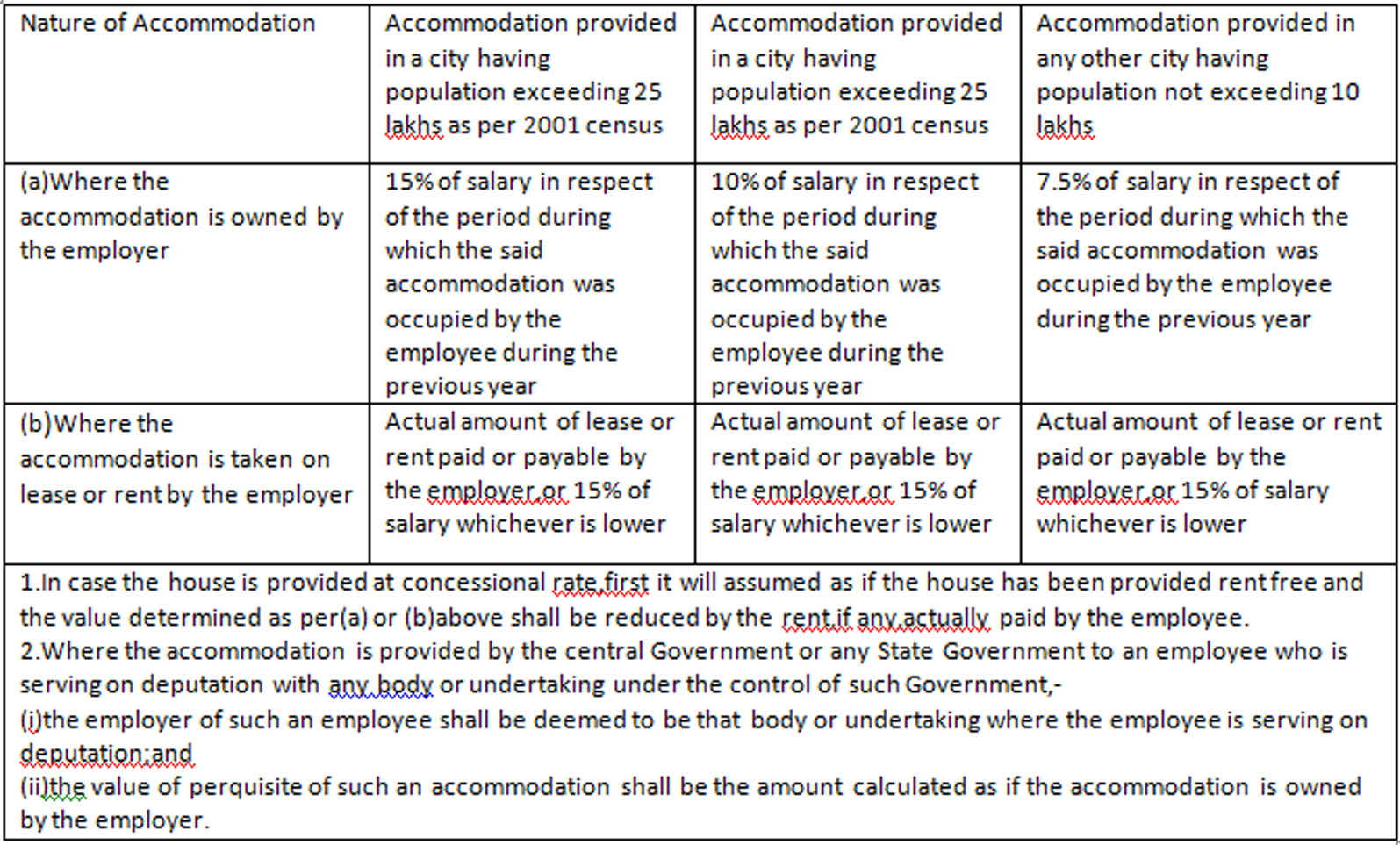

(i) Where the accommodation is unfurnished : Nature of Accommodation Accommodation provided in a city having population exceeding 25 lakhs as per 2001 census Accommodation provided in a city having population exceeding 25 lakhs as per 2001 census Accommodation provided in any other city having population not exceeding 10 lakhs

(a) Where the accommodation is owned by the employer 15% of salary in respect of the period during which the said accommodation was occupied by the employee during the previous year 10% of salary in respect of the period during which the said accommodation was occupied by the employee during the previous year 7.5% of salary in respect of the period during which the said accommodation was occupied by the employee during the previous year

(b) Where the accommodation is taken on lease or rent by the employer Actual amount of lease or rent paid or payable by the employer,or 15% of salary whichever is lower Actual amount of lease or rent paid or payable by the employer,or 15% of salary whichever is lower Actual amount of lease or rent paid or payable by the employer,or 15% of salary whichever is lower

1. In case the house is provided at concessional rate,first it will assumed as if the house has been provided rent free and the value determined as per(a) or (b)above shall be reduced by the rent,if any,actually paid by the employee.

2. Where the accommodation is provided by the central Government or any State Government to an employee who is serving on deputation with any body or undertaking under the control of such Government,-

(i) the employer of such an employee shall be deemed to be that body or undertaking where the employee is serving on deputation;and

(ii) the value of perquisite of such an accommodation shall be the amount calculated as if the accommodation is owned by the employer.

(ii) Where the accommodation is furnished :The value of perquisite shall be determined as if it is an unfurnished accommodation(i.e,value determined as per chart given above.Such value shall be increased by 10%p.a. of the cost of furniture(including television sets,radio sets,refrigerators,other household appliances,air conditioning plant or equipment or other similar appliances or gadgets) or if such furniture is hired from a third party,the actual hire charges payable for the same.Such valuation of furniture shall be as reduced by any charges paid or payable for such furniture by the employee during the previous year,

In case the furnished house is provided at concessional rent,it will be first assumed as if it has been provided as rent free furnished accommodation and shall be valued as above.Thereafter,any amount recovered from the employee as rent shall be deducted from such valuation.

(C) Where the accommodation is provided by the employer(Government or other employer)in a hotel :

The value of the accommodation shall be :

(i) 24% of salary paid or payable for the previous year,or;

(ii) the actual charges paid or payable to such hotel;

Whichever is lower,for the period during which such accommodation is provided.

NOTE : Meaning of salary for rent free accommodation :’Salary’ includes the pay,allowances,bonus or commission payable monthly or otherwise or any monetary payment,by whatever name called from one or more employers.

PERQUISITE TAXABLE IN THE HANDS OF SPECIFIED EMPLOYEES :

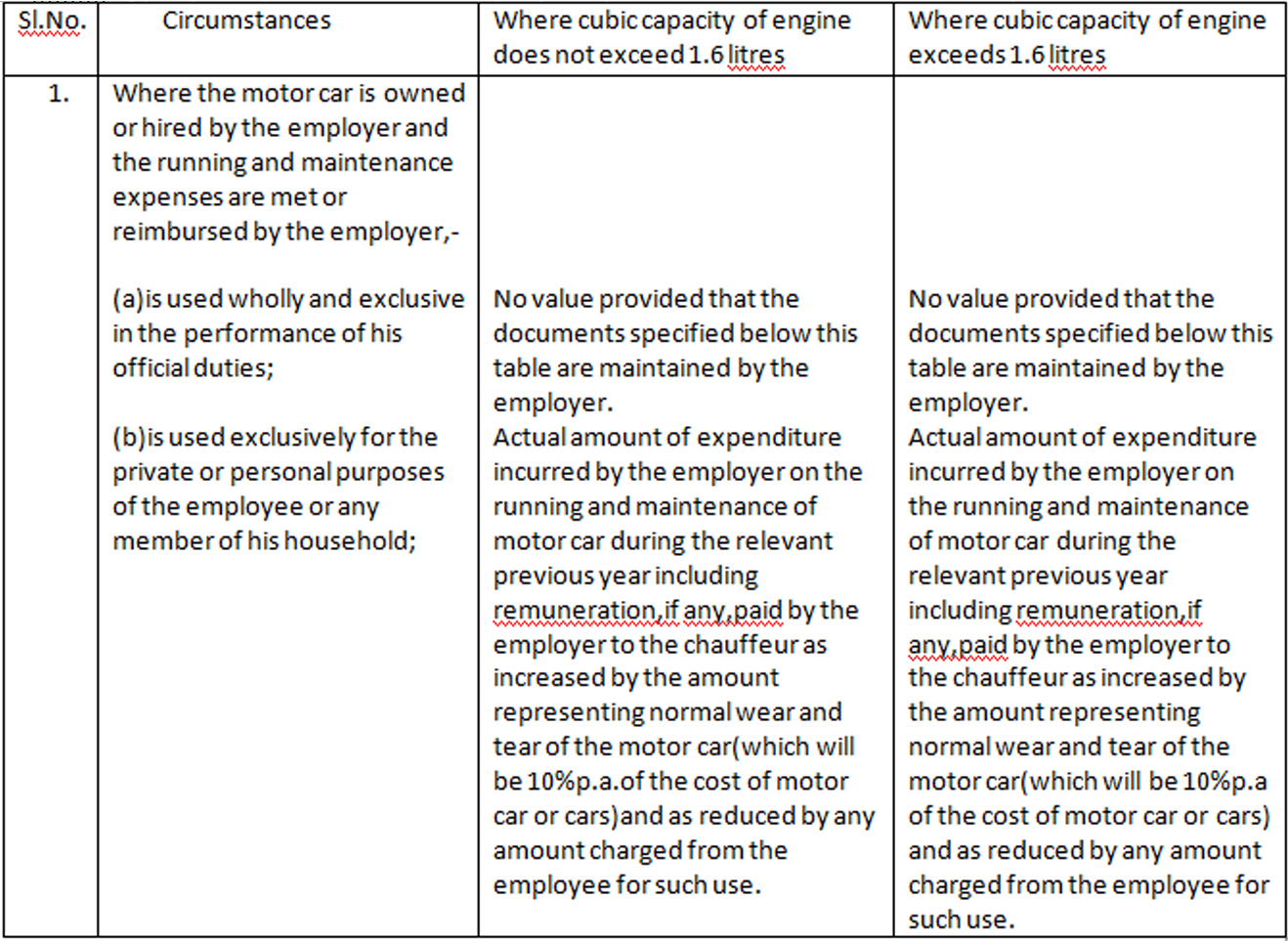

Valuation of motor car/other vehicles[Rule 3(2)] :As already discussed,motor car/other vehicles,provided by the employer,is a perquisite only for specified employees because it is facility provided by the employer to the employees.On the other hand,if the car belongs to the employee and the expenses of running and maintenance of that car are met by the employer,it becomes a perquisite taxable in the hands of all employees as it is an obligation of the employee to maintain his car but such obligation is being met by the employer.

( Value of perquisite per calendar month(only completed calendar months to be taken)

Systematic Approach To Income Tax